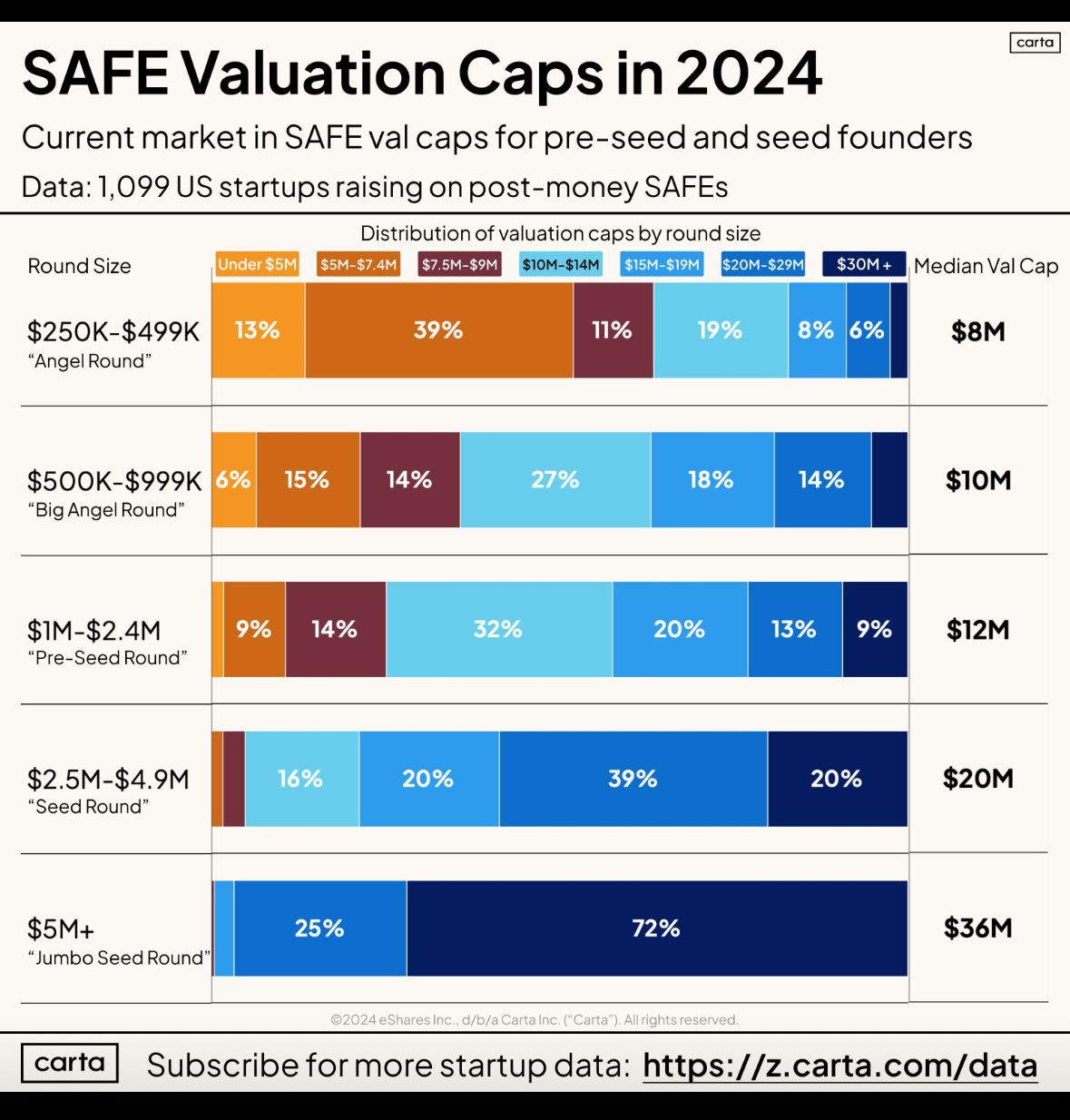

What should my valuation cap be?

The number one question I get from pre-seed and seed founders who've decided to fundraise on SAFEs.

𝗛𝗲𝗿𝗲'𝘀 𝘄𝗵𝗮𝘁 𝘁𝗵𝗲 𝗱𝗮𝘁𝗮 𝘀𝗮𝘆𝘀:

Raising $250K-$499K | "Angel Round"

• Median val cap is $8M

• The segment of val caps from $5M-$7.5M is most common

Raising $500K-$999K | "Big Angel Round"

• Median val cap is $10M

• The tier $10M-$14M is most common

Raising $1M-$2.4M | "Pre-Seed Round"

• Median val cap is $12M

• The tier $10M-$14M is most common

Raising $2.5M-$4.9M | "Seed Round"

• Median val cap is $20M

• The tier $20M-$29M is most common

Raising $5M + | "Jumbo Seed Round"

• Median val cap is $36M

• The tier $30M+ is most common

Hope this info helps you close your early capital!

Follow My Friends:

Startup PromoTix ($48M in traction) is saving the events industry

PromoTix is solving the event industry’s challenges around high ticket fees and low attendance. Ticketmaster and competitors charge up to 40% of the ticket price to book, deterring guests who can’t afford the added cost. Combined with a crowded marketing space, events struggle.

PromoTix is raising funds to expand. Already profitable, with 656k users and $48M in sales in its first 30 months, PromoTix has low-fee and no-fee SaaS pricing, as well as patented marketing tools that drive attendance.