Tapping into the Future: Emerging Industries in Equity Crowdfunding.

As the world evolves, so too does the landscape of investment opportunities. This has become increasingly evident in the world of equity crowdfunding, a sector that has enabled retail investors to delve into industries previously inaccessible due to barriers of high capital requirements and complex regulatory processes. As we navigate the decade, several emerging industries are setting the stage for a new era of investment opportunities. Let's explore some of these sectors, in order to provide a comprehensive understanding for those considering investing in an equity crowdfunding campaign.

1. Sustainable Technology.

The call for sustainable solutions has never been louder. As the world grapples with climate change, companies dedicated to sustainable technology have come to the forefront. From renewable energy to electric vehicles and beyond, these businesses are seeking funding to innovate and scale their operations. Equity crowdfunding has been instrumental in facilitating this, providing a viable way for retail investors to back these companies early on and potentially reap significant returns as they grow.

2. HealthTech.

The HealthTech industry has experienced exponential growth in the past few years, driven by the pandemic and the subsequent demand for remote healthcare solutions. Startups in this space, focusing on telemedicine, digital health records, AI diagnostics, and more, are increasingly turning to equity crowdfunding. As an investor, this offers a unique chance to contribute to the transformation of healthcare while potentially profiting from this booming industry.

3. Agritech.

As the global population grows, the need for more efficient, sustainable farming methods is becoming urgent. Agritech startups, addressing this need through innovations such as vertical farming, precision agriculture, and farm management software, are becoming hot targets for equity crowdfunding. This is an exciting opportunity for investors interested in supporting sustainable food production and capitalizing on an industry poised for significant growth.

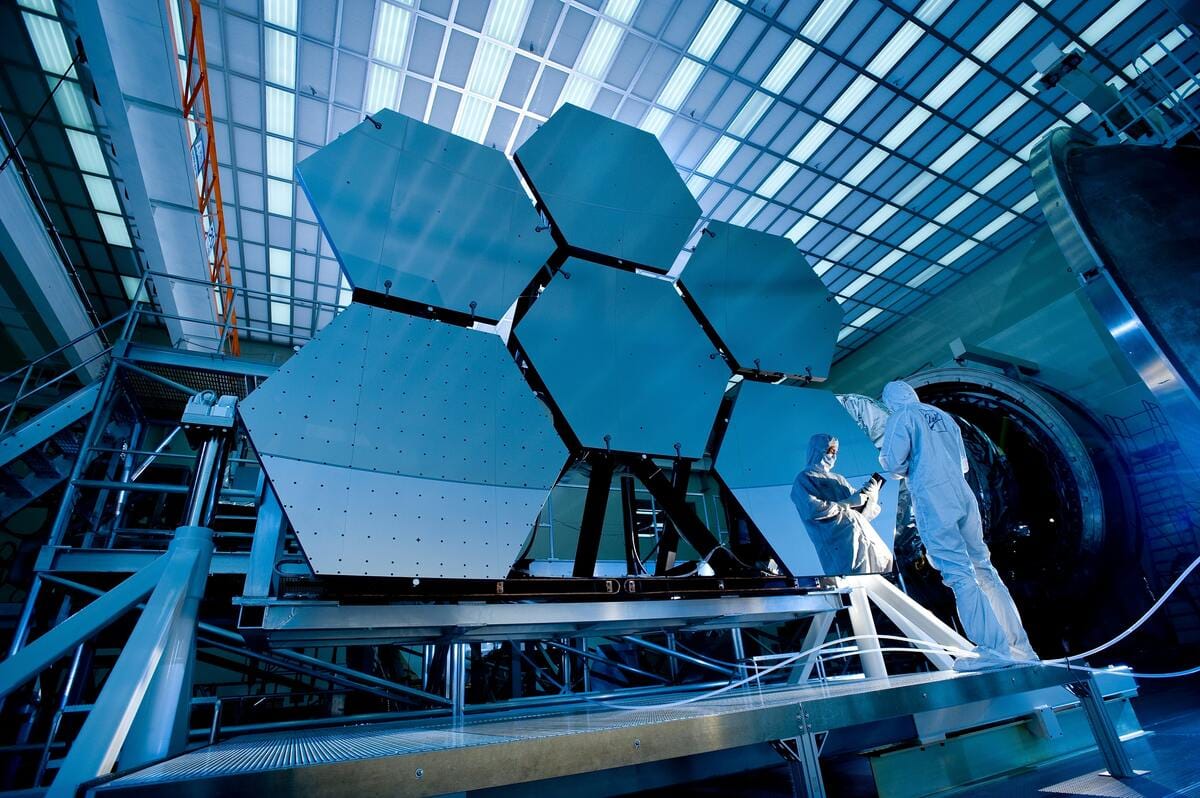

4. Space Technology.

Once the realm of government entities and billionaires, space exploration is becoming increasingly democratized. More and more, startups focused on satellite technology, space tourism, and even asteroid mining are turning to equity crowdfunding to raise capital. While this industry is undoubtedly risky, the potential for high returns could make it a thrilling venture for retail investors with a high-risk tolerance.

5. EdTech.

The education sector has undergone a major shift towards digitalization, and EdTech startups are leading the charge. These companies, developing online learning platforms, AI tutoring, and other tech-driven educational resources, are increasingly seeking funding through equity crowdfunding. For investors, this is a chance to support the advancement of education while capitalizing on an industry with tremendous growth potential.

Investing in equity crowdfunding offers retail investors an exciting opportunity to support and participate in the growth of innovative startups. As with all investments, it is important to conduct thorough research and understand the risks involved. However, for those willing to embrace these risks, the emerging industries outlined above represent some of the most promising sectors in today's equity crowdfunding landscape.

Remember, investing should always align with your personal financial goals and risk tolerance. Keep an eye on these burgeoning industries, and consider how they might fit into your broader investment strategy. Equity crowdfunding is not just about funding the next big thing; it's about believing in a future that you want to help create and being a part of the journey that gets us there.